Using Capital Gains Tax Treatment to Save on Taxes

Understanding capital gains is important if you are trying to optimize your taxes and keep more of what you earn. Capital gains tax rates are typically lower than ordinary income tax rates, so using capital gains treatment can allow you to minimize your tax burden in many cases. (Reach out to one of our tax experts to discuss your specific situation.) Before we define a capital gain, let’s talk about capital assets.

What is a Capital Asset?

A capital asset is a significant piece of property or investment. When it comes to your personal life, it could be a home, a car, stocks and bonds, a costly piece of jewelry or art, or other collectibles. For your business, a capital asset is an asset that has a useful life longer than a year, and one that is not intended to be sold during the regular course of business operations. For example, if you purchase a computer to be used by you or your employees to run your business, that is a capital asset. If you are an IT retailer and you purchase a computer to sell, that is considered inventory—not a capital asset.

What Are Capital Gains?

Now that we have a working definition of a capital asset, we can talk about capital gains. A capital gain is an increase in the value of a capital asset when it is sold—if you sell a personal or business asset for more than you originally paid for it, you have a capital gain. Conversely, if you sell the asset for less than its original cost, you have a capital loss. Capital gains are realized when you sell the asset.

How Does Timing Affect Your Capital Gains Status?

One year is the key time period when it comes to distinguishing between short-term and long-term capital gains. If you sell an asset before you’ve held it for one year, any gains or losses on that asset will be short-term capital gains/losses. If you’ve held it longer than one year, those gains or losses will be considered long-term capital gains/losses. Both types of capital gains must be claimed on your annual tax return, but they are taxed differently.

Capital Gains Tax

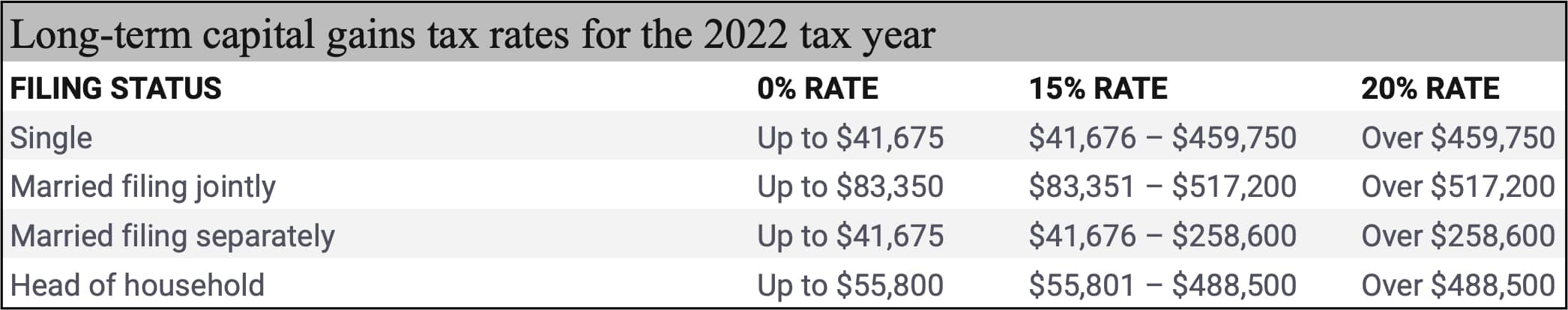

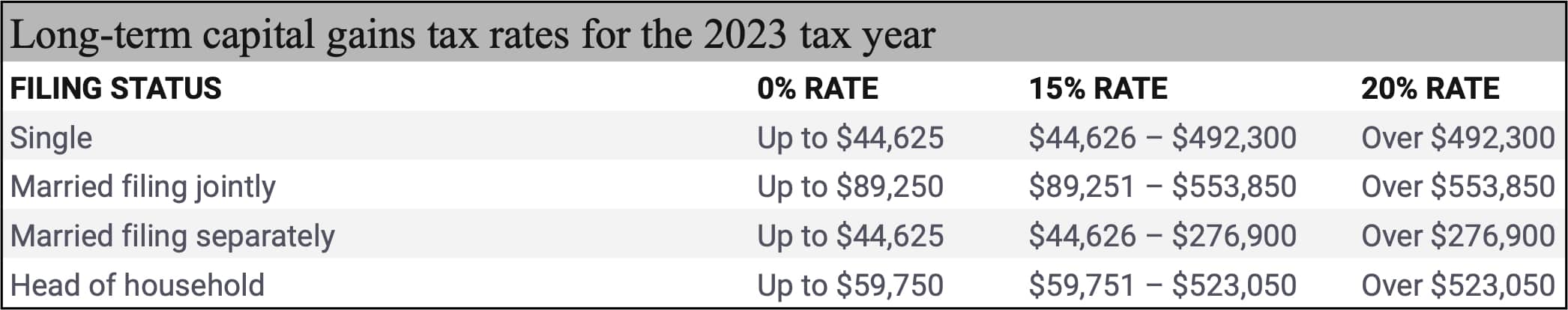

In order to qualify for treatment as a long-term capital gain on your tax return, you must hold the asset for longer than one year. Short-term gains are taxed as ordinary income at a rate that is determined by your tax filing status and adjusted gross income (AGI). If you have long-term capital gains, however, you will see a lower tax rate applied to those gains. That rate depends on your income and marital status. You can see the capital gains tax rates for 2022 and 2023 below:

What Assets Are Eligible for Capital Gains Treatment?

Generally, the following personal assets are eligible for capital gains tax treatment: financial instruments such as stocks, bonds, and cryptocurrency, NFTs, jewelry, homes, furnishings, and collectibles, fine art, timber, and vehicles. Assets that are not eligible for capital gains treatment include business inventory, copyrights, patents, and inventions, depreciable business property, real estate used for your business or as a rental property, and intellectual property such as literary or artistic creations. If you have questions about your assets and taxes, our advisors are here to help.

Special Circumstances

Certain types of assets have unique rules and taxation rates. Our tax advisors can help you understand if your assets are affected by these unique rules, but we’ve listed a few notable examples and special situations here:

- Real estate gains can be taxed as high as 25%.

- Certain types of stock or collectibles may be taxed at a higher 28% capital gains rate

- If your capital gains put your income over the threshold for the 15% capital gains rate, any excess income will be taxed at the higher 20% rate.

- Certain types of capital losses cannot be deducted. For example, selling your house or car at a loss does not give you a tax deduction.

- When you sell your primary home, the first $250,000 is exempt from capital gains tax. (That figure doubles to $500,000 for married couples.)

- High-net-worth investors may have to pay the additional net investment income tax on top of the 20% they already pay for capital gains.