Here at PRIME, we talk about taxes a lot, and often, we’re talking about ways you can optimize your business structure and strategy to minimize your federal income tax burden. But there are other types of taxes as well, and it pays to be savvy about all of your tax liabilities to minimize your tax expenditure. State income taxes, state property taxes, and state sales tax are all ways that you contribute to your state to pay for things like municipal services (think schools, firefighters, and police) as well as infrastructure (roads, buildings, etc.).

In this article, we’re going to discuss real estate property taxes, which vary greatly from state to state. If you are an entrepreneur or someone who owns their own business, you may have some flexibility when it comes to your home state, so being strategic about your home’s location and thinking about property taxes could pay off big for you. Even if you’re tied to one location, it’s a smart financial play to fully understand all of your liabilities, so read on for more information on property taxes + a list of real estate tax rates by state.

Compare State-By-State Property Tax Rates

What Are the Types of Property Taxes?

In most states, there are two types of property taxes: real estate taxes (homes and land) and personal property taxes (cars, boats, etc.). Because real estate is typically the biggest driver of your property tax bill, we’ll focus on real estate property taxes in this article.

Who Collects Property Taxes?

In most states, property taxes are assessed and collected by your local jurisdiction. This means that there typically isn’t one property tax rate across the entire state, but rather multiple rates depending on your county, city, township, or other municipal jurisdiction. When we compare state property tax rates, we’re using the average rate across the state.

What Determines My Property Tax Cost?

There are two important factors in determining how much property tax you owe: the applicable tax rate, and the value of your real estate. Your tax bill is simply the product of the two: ASSESSED VALUE x TAX RATE = TAX BILL.

An assessor in your jurisdiction will set the value of your property, which may or may not match the estimated market value. They will consider things like size of your lot/land, the size and condition of any structures on the property, and location of your property. If you disagree with the assessed value of your property, there is normally an appeals process you can go through to try to get that value lowered.

How Do I Pay My Property Taxes?

Your local tax assessor will determine the value of your home, apply the relevant tax rate, and send you a bill. If you’ve purchased your home through a mortgage lender, you will most likely pay your property taxes to your lender as part of your monthly payment, and the loan servicer will remit the tax payments to your jurisdiction as part of their servicing agreement. If you’ve paid off your mortgage (or paid cash for your home), you will pay your property taxes directly to your local jurisdiction—the bill you receive should specify the physical address for mailing the payment or a way to pay the bill online.

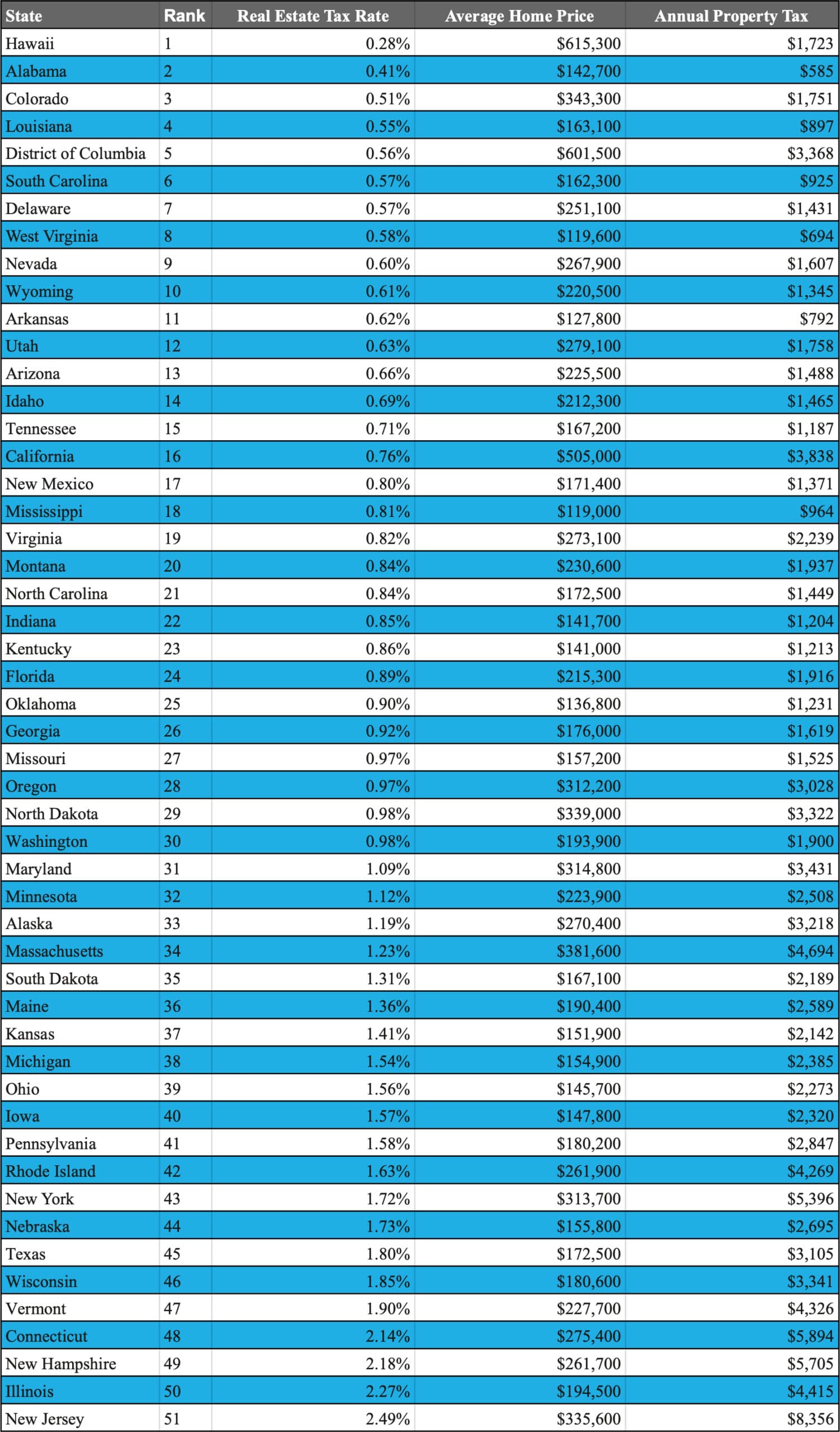

State-By-State Property Tax Rates

In the table below, you can find the average property tax rate for each state. (Remember, property tax rates vary by municipal jurisdiction, so this is just an average. For the precise tax rate in your county or city, check with your local tax authority.) The data below comes from WalletHub, using 2019 data (the most recent available data). Hawaii comes in as the number one state with the lowest average property tax rate (0.28%) while New Jersey ranks #51 with the highest rate (2.49%).

State Property Tax Exemptions

For almost all U.S. homeowners, property taxes are a fact of life. But in some unique cases, you may be eligible for a state property tax exemption. If you are a senior citizen, a STAR participant, a veteran, a low-income homeowner, or someone with a disability, it’s worth checking with your local tax authority or other local services to see if you are exempt from state property taxes.

State Property Tax Rates – FAQs

If I’m a renter, should I care about state property tax rates?

If you’re a renter, you may think that property tax rates don’t affect you. After all, you don’t own the property, so you’re not responsible for paying the tax bill. In reality, the property owner often passes all of the costs of ownership on to the renter in the form of a higher rent rate. So a higher tax bill often translates to a higher rent payment for you.

What happens if I don’t pay my state property tax?

Property taxes are legally biding financial obligations, and if you don’t pay them in a timely manner, you will face consequences. In most locations, your local tax authority will place a tax lien on your property if you don’t pay your taxes. This lets your creditors know that the government has legal rights to your property. If you still fail to pay the tax bill, the government can seize the property or take the past due taxes from the proceeds of any sale of the property. Bottom line – a tax lien is not something you want to mess with, so it’s important to pay your property taxes in full and on time.

Are property taxes deductible when I pay my federal taxes?

State and local taxes are typically deductible on your federal return, though limits may come into play in some scenarios. Reach out to a tax advisor with questions about your specific situation.