PRIME’s tax experts help you understand how to take advantage of education tax credits and deductions.

If you paid for college in the last year—for yourself, your spouse, or your dependent—you may be able to claim the American opportunity tax credit (AOTC) or the lifetime learning credit (LLC). You may also be able to deduct interest paid on student loans. You can learn more about your options for reducing your tax burden with our guide to education tax credits and deductions below, and our advisors are only a click away if you want personal attention.

Tax Credits Vs. Tax Deductions

Before we dive into the nuances of education tax strategies, let’s review the basics. Tax credits and tax deductions are both great ways to save on your taxes, but they are two distinct things.

- Tax deductions reduce the amount of your income that is subject to taxation. A deduction will lower your taxable income by the percentage of your highest federal income tax bracket. For example, if you fall into the 22% tax bracket, then a $2000 deduction saves you $440 ($2000 X 22%).

- Tax credits reduce the amount of tax you owe in a dollar-for-dollar manner. For example, if you have a tax credit valued at $2000, then your tax bill is lowered by $2000.

Education Deductions

First, let’s take a look at the deductions you might be able to use. Remember, deductions reduce the amount of income subject to income tax, so they increase the amount of income you can keep. If you’re using the standard deduction, you can’t itemize individual deductions. But if you are itemizing your deductions and you’ve got a student in your household, these education deductions may come in handy. Deductions for education expenses include:

- Student loan interest—you can deduct up to $2,500 from gross income. Income limitations apply.

- Business deduction—if your educational expenses are related to your business, you may be able to deduct the cost of education on Schedule C or F.

Education Tax Credits

As we mentioned earlier, tax credits reduce the amount of income tax you have to pay in a dollar-for-dollar model. As always when it comes to the IRS, income limitations apply. There are two important education tax credits you should know about:

- American Opportunity Credit—$2,500 maximum per student per year.

- Lifetime Learning Credit—$2,000 maximum per tax return per year.

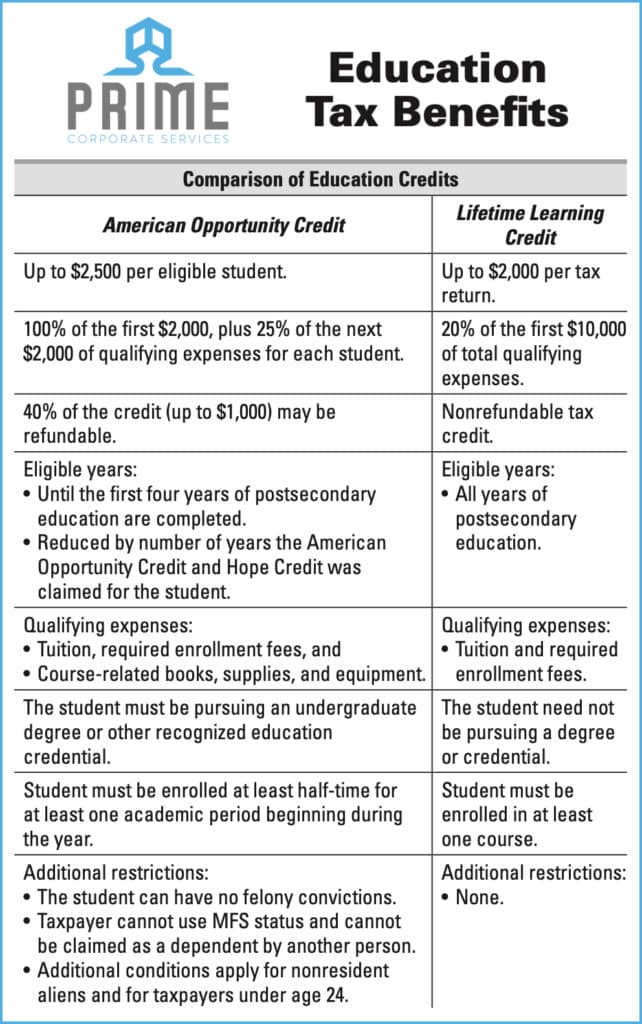

We’ll take a look at each tax credit in depth below, but this chart summarizes some of the key differences in the two education tax credits.

American Opportunity Tax Credit (AOTC)

According to the IRS, the “American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student. If the credit brings the amount of tax you owe to zero, you can have 40 percent of any remaining amount of the credit (up to $1,000) refunded to you.”

The credit is calculated based on 100 percent of the first $2,000 of qualified education expenses you paid for each eligible student plus 25 percent of the next $2,000 of qualified education expenses you paid for that student.

Who is an eligible student for AOTC?

Students are eligible for AOTC if they:

- Are pursuing a degree or other recognized education credential

- Are enrolled for a minimum of 50% of the time for at least one academic period* beginning in the tax year

- Have not finished the first four years of higher education at the beginning of the tax year

- Have not claimed the AOTC or the former Hope credit for more than four tax years

- Have not had a felony drug conviction at the end of the tax year

*Academic Period can be semesters, trimesters, quarters or any other period of study such as a summer school session. Each school determines the relevant academic period. For schools that use clock or credit hours and do not have academic terms, the payment period may be treated as an academic period.

What are the income limits for AOTC?

- To claim the full credit, your modified adjusted gross income (MAGI) must be $80,000 or less ($160,000 or less for married filing jointly).

- You receive a reduced amount of the credit if your MAGI is over $80,000 but less than $90,000 (over $160,000 but less than $180,000 for married filing jointly).

- You cannot claim the credit if your MAGI is over $90,000 ($180,000 for joint filers).

MAGI for most people is the amount of AGI, adjusted gross income, shown on your tax return. If you file Form 1040, you add the following amounts to your AGI:

- Foreign earned income exclusion,

- Foreign housing exclusion,

- Foreign housing deduction,

- Exclusion of income by bona fide residents of American Samoa, or of Puerto Rico.

Lifetime Learning Credit (LLC)

The lifetime learning credit (LLC) differs from the AOTC in a few key ways. Most importantly, this credit can help pay for undergraduate, graduate and professional degree courses — including courses to acquire or improve job skills. There is no limit on the number of years you can claim this credit, which is worth up to $2,000 per tax return.

Who can claim the LLC?

In order to claim the LLC, you must meet all three of the following:

- You, your dependent or a third party pay qualified education expenses for higher education.

- You, your dependent or a third party pay the education expenses for an eligible student enrolled at an eligible educational institution.

- The eligible student is yourself, your spouse or a dependent you listed on your tax return.

Who is an eligible student for LLC?

To be eligible for LLC, the student must:

- Be enrolled or taking courses at an eligible educational institution.

- Be taking higher education course or courses to get a degree or other recognized education credential or to get or improve job skills.

- Be enrolled for at least one academic period* beginning in the tax year.

*Academic Period can be semesters, trimesters, quarters or any other period of study such as a summer school session. Each school determines the relevant academic period. For schools that use clock or credit hours and do not have academic terms, the payment period may be treated as an academic period.

What are the income limits for LLC?

- For TY2020, the amount of your LLC is gradually reduced (phased out) if your MAGI is between $59,000 and $69,000 ($118,000 and $138,000 if you file a joint return).

- You can’t claim the credit if your MAGI is $69,000 or more ($138,000 or more if you file a joint return).

Claiming Education Tax Credits

To be eligible to claim the AOTC or the Lifetime Learning Credit (LLC), the law requires a taxpayer (or a dependent) to have received Form 1098-T, Tuition Statement, from an eligible domestic or foreign educational institution. Generally, students receive a Form 1098-T from their educational institution by January 31. This statement helps you figure your credit.

Check the Form 1098-T to make sure it is correct. If it isn’t correct or you do not receive the form, contact your school.

To claim AOTC, you must complete the Form 8863 and attach the completed form to your tax return.

What About Education Savings Plans?

Contributions made to education savings plans are not federally tax deductible, but the earnings accumulate tax free. In addition, no tax will be owed on distributions if they are less than the beneficiary’s qualified education expenses. Qualified expenses are reduced by scholarships, other tax-free assistance, and amounts used to figure education credits.

Qualified Tuition Programs (QTPs)

States sponsor QTPs to allow prepayment of a student’s qualified higher education or elementary and secondary (K-12) education expenses. For information on a specific QTP, you need to contact the state agency or eligible educational institution that established and maintains it.

You may not distribute more than $10,000 in expenses for tuition during the taxable year for a public, private, or re- ligious elementary or secondary school from a 529 Plan.

Distributions in excess of $10,000 are subject to tax. This limitation applies on a per-student basis, rather than a per-account basis.

Note: QTPs are also called 529 Plans because they are au- thorized under section 529 of the Internal Revenue Code.

Education Tax Credits and Deductions—FAQs

How do I know if I am eligible for Education Tax Credits?

The IRS has an online interactive tool to help you understand your eligibility for Education Tax Credits. You will need the following information to complete interactive questionnaire:

- Filing status.

- Student’s enrollment status.

- Your adjusted gross income.

- Who paid the expenses, when the expenses were paid, and for what academic period.

- If any expenses were paid with tax-exempt funds.

- If any expenses were paid with distributions from a Coverdell Education Savings Account or Qualified Tuition Program.

You can also reach out to a PRIME advisor for help with this and any other tax prep questions you may have.

Where do I claim education credits?

Education credits such as that American opportunity tax credit and the lifetime learning credit are claimed on Form 8863.

Can I claim the AOTC and the LLC?

The IRS does not allow double benefits. This means that you can’t take the AOTC and LLC for the same student in the same tax year. In addition, you must subtract the amount of any tax-free educational assistance you receive, such as a grant, from your qualified education expenses.