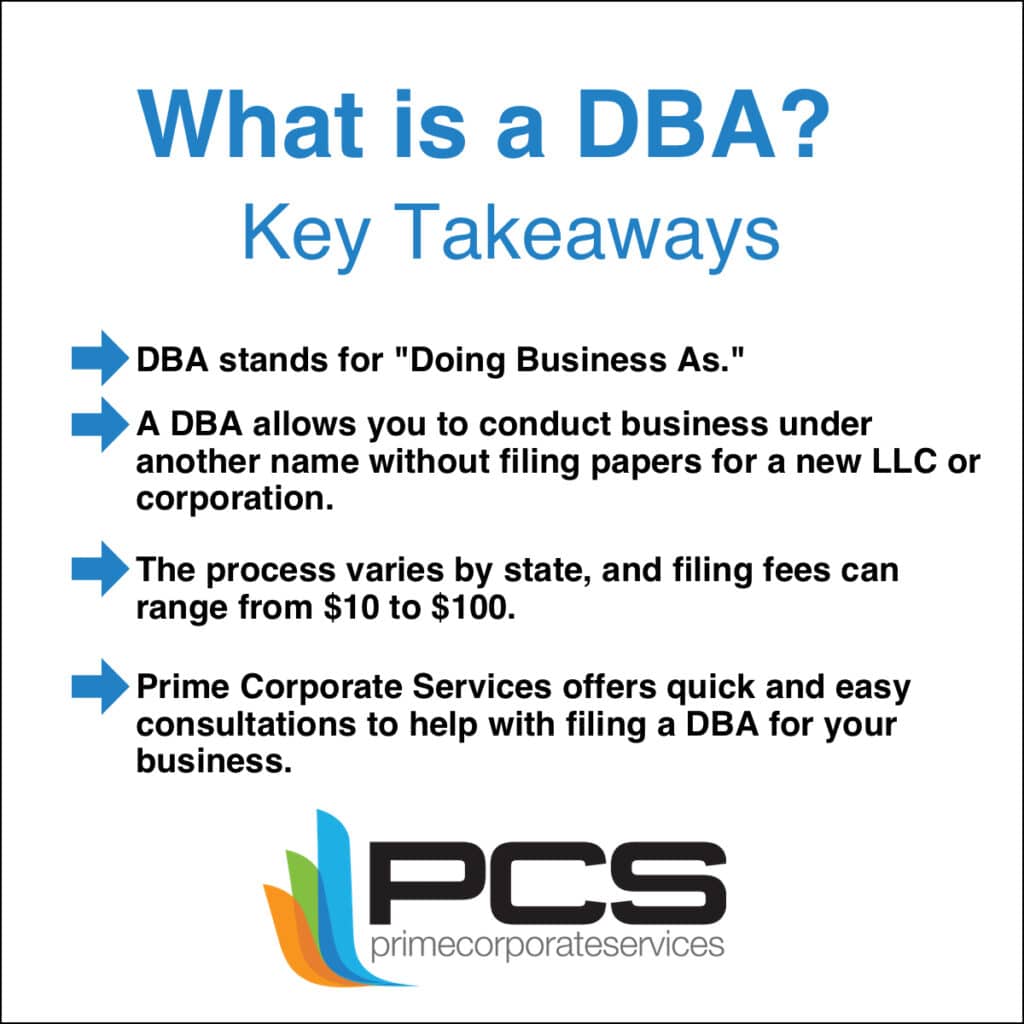

What is a DBA? If you’re an entrepreneur or small business owner, you’ve probably heard the acronym from time to time and wondered, “What does DBA stand for?” DBA is a term that means “Doing Business As.” A DBA is any registered name that a business operates under that isn’t its legal business name. If your business operates under any name other than its legal business name, you need to register that name as a DBA. Maybe you’d like to run your registered business entity under a different name or branch into new markets with new branding, or perhaps your business is an unregistered sole proprietorship and you’d like to use something other than your personal name—if so, now is the time to learn more about a DBA filing.

A DBA is NOT a Business Structure

Don’t confuse a DBA with an LLC, a corporation, or any other type of protective business structure. A DBA simply allows you to legally operate under a different name, but it doesn’t provide any protection for you or your assets. Unless you are running a very small and simple business model with very little profit and very little risk, we always advise that you take advantage of the protection offered by an LLC or corporate structure. (Check out our guide to LLCs for more information about the benefits, or sign up for a free consultation to see how Prime can help you choose the business structure that’s right for your needs.)

Why Should Sole Proprietors Use A DBA?

Using a DBA for your business doesn’t give you any liability protection, but it does have a few important benefits. The benefits of a DBA for a sole proprietor include:

- Financial flexibility—if you are a sole proprietor who hasn’t set up your business as an LLC, using a DBA allows you to write invoices and accept payments in your business’s name. This can build credibility and legitimacy for your small business.

- Personal privacy—when you use a DBA, your customers don’t need to see your personal name.

- Increased options for branding and marketing—without a DBA, a sole proprietor must use their name for all marketing and branding. This can limit your ability to be creative and draw in new customers using your website, ads, or social media.

Benefits of A DBA For LLC’s & Corporations

If you have already set up your business entity with a formal structure, you don’t need a DBA to bank in your business’s name, keep your name private, or market your business using your name and brand. These features are already included in your business structure. Instead, LLCs and corporations often use DBAs when they want to expand their business or rebrand.

For example, AAA Handyman Services might decide that they see a big opportunity to focus their skills and expertise in painting. They may want to rebrand themselves as AAA Painting Services and offer speciality painting services instead of (or in addition to) their general handyman services. In this instance, it’s not necessary to file for a new LLC—a DBA will allow them to “create” their painting business with a new name and branding but continue to operate under their existing business structure.

Setting Up A DBA

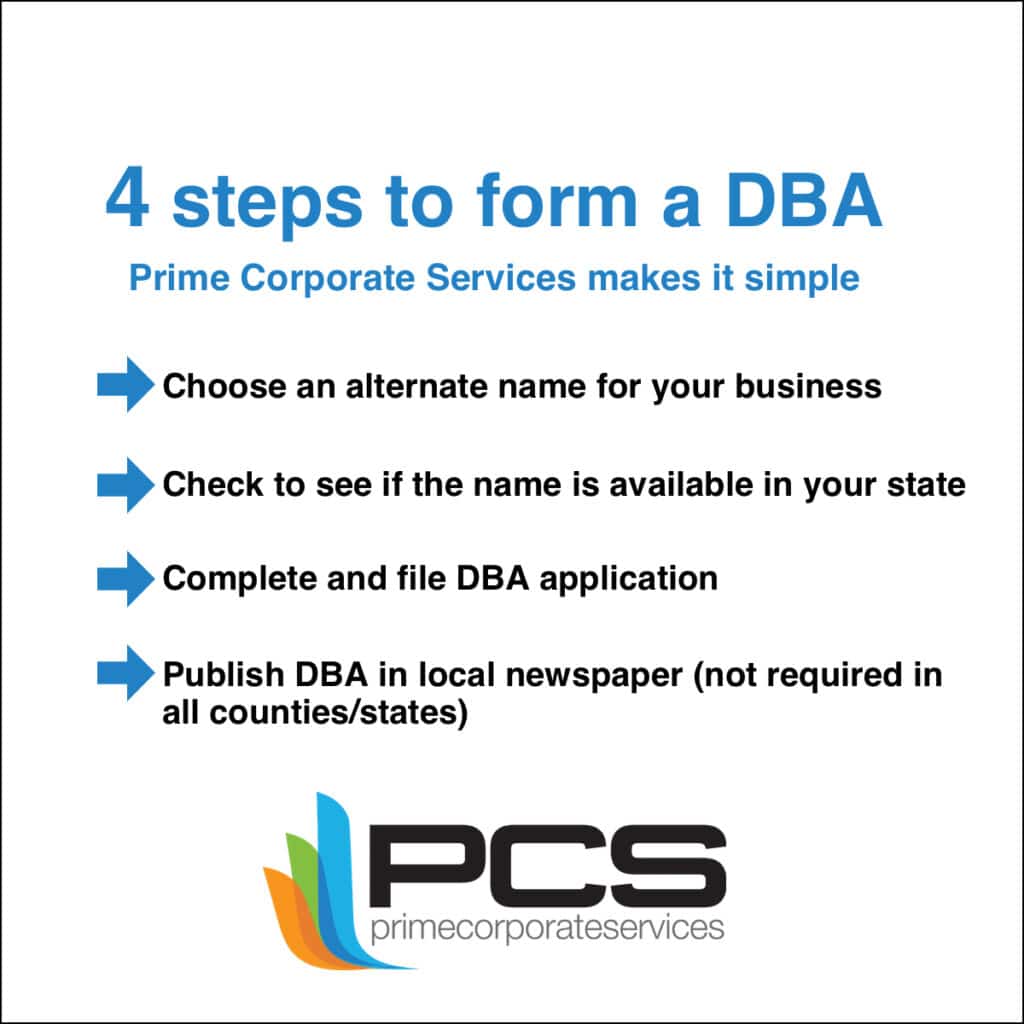

The specific steps and fees related to setting up a DBA vary from state to state. If you want to set up a DBA in your state, the first step is to check and make sure the name is available. If the name you want is free, the next step is to complete and file the DBA application with the proper state office. In many cases, this is the Secretary of State’s office. Once that application is complete, some counties require that the new DBA be published in a local newspaper. Prime Corporate Services can help with all parts of the DBA process—set up a consultation today for more information.

DBA FAQs

What is the difference between LLC and DBA?

An LLC is a legal business structure that provides protection for you and your personal assets. A DBA is a formal structure that allows you to use an alternate name for your business, but provides no protection. Depending on your state, a DBA does not typically “claim” a name for your use only, or if it does, that claim typically only holds in your county or state.

Does a DBA need a separate bank account?

A DBA does not require a separate bank account, but the ability to use a business bank account and keep your personal finances separate is one of the main benefits of a DBA for a sole proprietorship.

What is a DBA example?

If John Doe operates a sole proprietorship car washing business, and he wants to use the name “AAA Car Washing” for marketing and accept payment as AAA Car Washing, he could file a DBA with his state to legally use it to do business.

How do I choose a DBA name?

Many factors go into choosing a name for your business. Choose a name that is meaningful to you and easy to use for branding and marketing. Be sure to check with your state to make sure the name is available before you spend too much time on marketing and branding ideas!

What is the purpose of filing a DBA?

The purpose of filing a DBA is to allow your company to legally conduct business under another name.

If you have any questions about how you are currently set up or would like to set up a business entity feel free to schedule a consultation to speak with a PRIME expert by clicking here!